For a full guide to the features and benefits of the different payroll software offered by Intuit, check out our QuickBooks Payoll Service guide. In this section, we will cover QuickBooks enhances payroll service.

#Quickbooks direct deposit form how to#

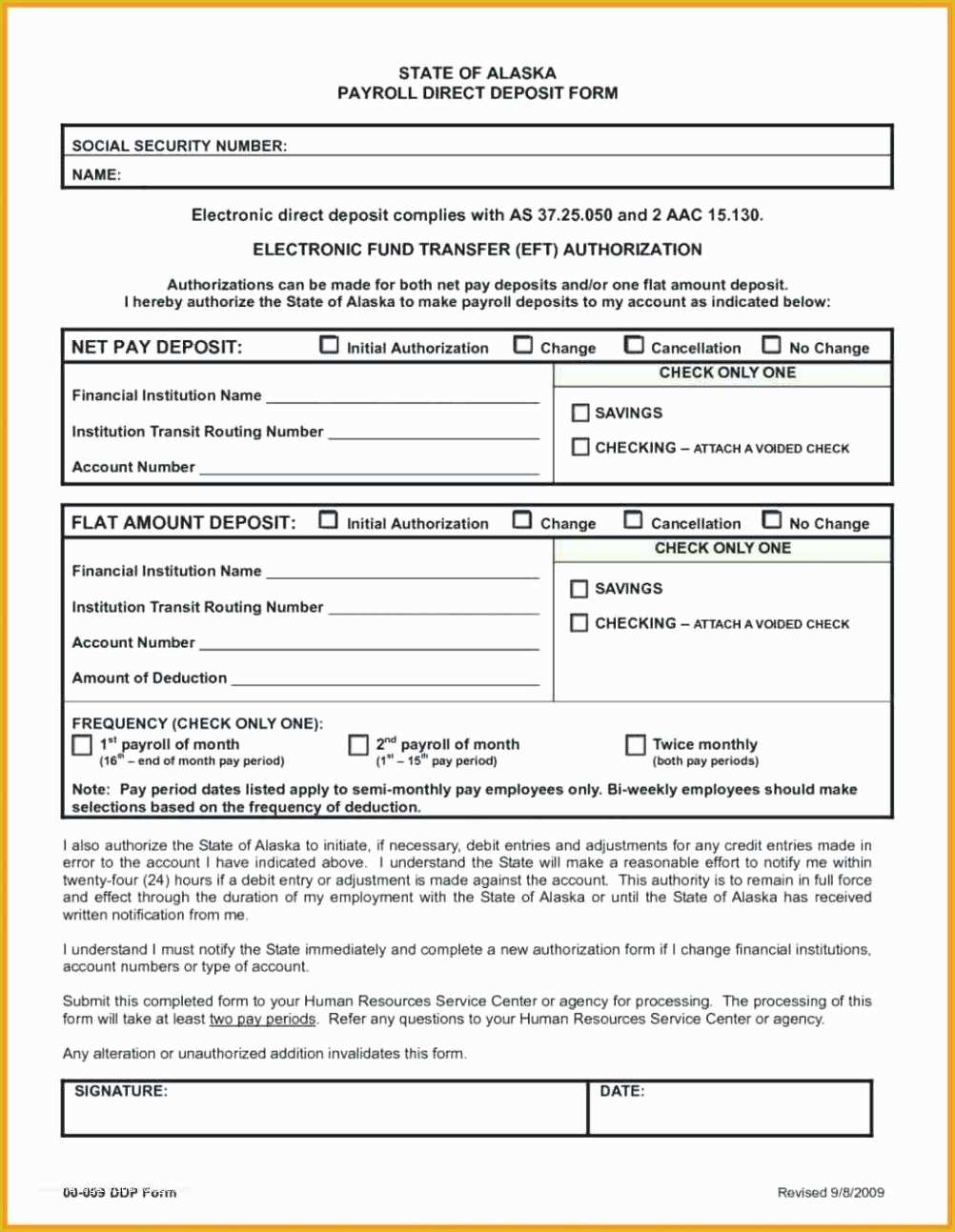

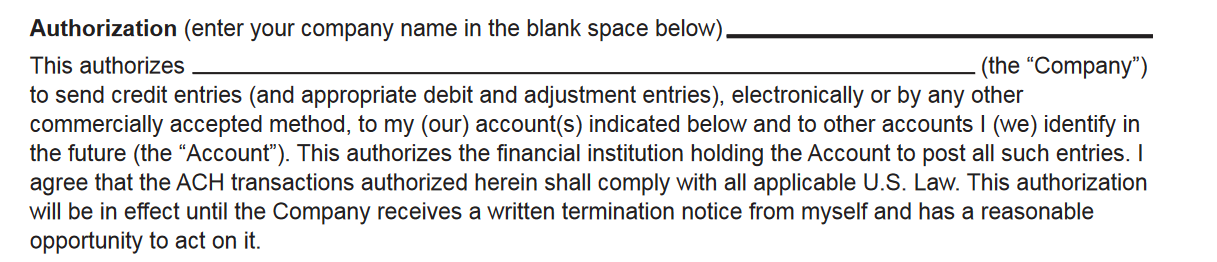

How to setup Quickbooks online payroll in 3 easy steps We will walk you through both step by step. To do so, you must have them complete a direct deposit authorisation form, which not only gives you permission to make deposits to their account, but it will include the bank account and routing information you need to make the deposit.ĭoing payroll in QuickBooks online involves setting up QuickBooks Online Payroll, an easy process that has 5 steps, and running payroll in QBO which can be done in 4 steps. You can offer your employees direct deposit in lieu of a check. The Hire Date for each employee must be entered during the payroll setup. In general, these hours will be earned each pay period. If you offer sick/vacation pay, you will need to enter this information for each employee.

For example, if you pay hourly employees every week and salaried employees every other week, you can set up both of these pay schedules. You can also set up multiple pay schedules if you need to in QuickBooks. In general, this will be weekly, bi weekly, semi monthly, or monthly.

The hourly rate or salary you pay each employee, along with any bonus or commission pay, if applicable.Įmployee contributions to health insurance, retirement plans, or garnishments. Upon hiring a new employee, you need to have them complete a W-4 form, which will provide you with their witholding information and other pertinent information you need in order to correctly calculate their payroll tax deductions. You will find a list below a list of employee items you will need in order to set up QuickBooks Online Payroll. In order for QuickBooks to calculate payroll checks for you, you will need Form W-4, the employee’s pay rate and deductions, and how often you will pay employees. Health and dental insurance, 401k, retirement plans, vacation/sick leave policy, or Flexible Spending Account.Īdd employee info in Quickbooks online payroll Hourly wages, salaries, bonuses, commissions, tips, and any other compensation you provide your employees. The full routing number and account number of the checking account that you will write payroll checks from as well as make your payroll tax payments. Listed below is the employer information you will need in order to complete QuickBooks Online Payroll setup: In addition, you should have the hourly rate or salary information along with other benefits you will offer employees, such as health insurance and retirement plans. You will need your business bank account and routing number of the bank account you will use to pay employees and make tax payments. Below is a checklist that you can use to ensure you have everything you will need.Īdd employer information in QuickBooks online payroll In order to follow along, you are going to need a few documents and pieces of information relating to your business and your employees handy. When you add Payroll to your existing QuickBooks Online subscription, your business gains access to benefits such as same day direct deposits, assistance with setting up your company’s payroll, and your taxes are prepared for yo u.ĭoing payroll in QuickBooks online involves setting up QuickBooks Online Payroll, an easy process that has five easy steps, and running payroll, which is fast and be done in four steps. We will show you what info you will need and provide step by step instructions on how to set up and process payroll in QuickBooks Online in nine easy steps. If you use Quickbooks Online, you can set up and run payroll easily in no time. Swipe Card Access Control Security Systemsĭoing your own payroll is one way for business owners to sav e money.Multispectral Fingerprint Door Entry Systems.Biometric Access Control Security Systems.Face and Palm Recognition with Temperature and Mask Detection.Time And Attendance Systems For Industries.

0 kommentar(er)

0 kommentar(er)